Relinquishment; as flamboyant the word in itself, as is its concept under law. Relinquishment or Haq-Tyag as it is known in some parts of Rajasthan and Uttar Pradesh refers to Transfer of an Inherited Property by One Co- Owner in Favour of another. Such an abandonment or surrender of Rights over a Property Inherited or owned jointly can be either due to Social reasons as for sisters relinquishing their right of ancestral property in favor of their brothers or Personal Reasons as the liabilities with Property are much more than benefits accrued from it.

Generally, Relinquishments comes into play among Legal Heirs for an Intestate Succession of a Property as per Hindu Succession Act, but it also refers to Relinquishment in case of Joint Owner or Tenants relinquishing Tenancy Rights.

Table of Contents

Right to Relinquish and Receive a Relinquished Property

A Property can only be relinquished by an Owner of the Property and only in the favor of another Owner, i.e., Any Inherited Property cannot be relinquished to any third person. In other words, only in the name of another Legal Heir can a Property be relinquished.

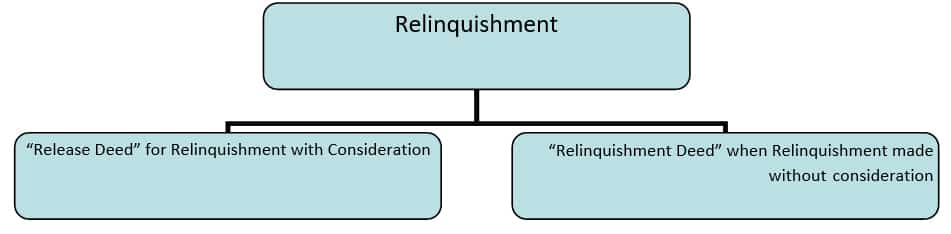

Such Relinquishment can either be made with or without Consideration.

Procedure for Relinquishment–

Any Relinquishment over a Property is made through Relinquishment Deed or Release Deed. Section 17 of Registration Act 1908 makes it mandatory for a Relinquishment Deed to be registered.

Such Deed for the purpose of Registration should be presented in a Proper Format in the Office of Sub- Registrar of Assurances under whose jurisdiction the said property lies in the presence of two witnesses. Any Relinquishment made in favor of Minor attracts the provisions of Indian Contract Act.

Unregistered Relinquishment Deeds are held not to be permissible evidence.

Peculiarities of Relinquishment Deed

- An Irrevocable Document i.e. cannot be revoked once registered.

- Shall be in Written form on a Legal Paper.

- Relinquished Property is always Inherited One.

- Undergoes Close Scrutiny from Registrar because people often tend to garb Gift Deed as Relinquishment Deed in order to avoid Cost

- Used for Realignment of Interest between parties.

- Attracts Stamp Duty similar to that of Gift Deed

- Attracts Capital Gains Tax on the Relinquished Property