Non-resident Indians (NRIs) frequently have deep connections with their homeland, and owning real estate is a wise investment as well as an emotional bond. However, overseas individuals may struggle to understand India’s complex land registration laws. The legal framework, qualifying requirements, necessary paperwork, and detailed procedures associated with the land registry process for NRIs are all described in this article.

Table of Contents

Land Registry Law, Eligibility, Documents and Process

Understanding the Legal Framework- Governing Laws for Land Registration

There are a number of significant laws which govern the land acquisition and property land registry processes for Non-Resident Indians (NRIs), ensuring legal and financial compliance. Some of the important laws are explained in brief:

- Foreign Exchange Management Act (FEMA), 1999: This act enacts and enables the orderly development and maintenance of the foreign exchange market in India. FEMA governs all foreign exchange transactions. There are special provisions for enabling NRIs to buy property in India such that such transactions follow prescribed foreign exchange standards and reporting requirements.

- The Registration Act, 1908: This act plays a vital role in the formalization of ownership status in India. It requires the registration of all property documents like sale deeds, lease deeds, and gift deeds at the office of the Sub-Registrar for the local jurisdiction. This formal registration safeguards the interests of property owners and establishes legal ownership.

- The Transfer of Property Act, 1882: This act in India serves as the basis for laws that outline the legal framework for the transfer of property rights. This act specifies lays the types of property to be transferred, the conditions for a valid transfer, and the rights and liabilities of the contracting parties in cases of property transfers. It ensures the rights of Non-Resident Indians (NRIs) undertaking real estate ventures.

- The Income Tax Act, 1961: The act addresses the issues of taxation aspects of property transactions to ensure that income obtained through sale, rental, or other similar activities is appropriately taxed. NRIs ought to know the tax rates, exemptions, and compliances that could impact their real estate investments in India.

- State-specific Land Reform Acts: Most states in India have state-specific land reform acts. These acts impose some restrictions and regulations on the purchase and utilization of property. Such laws can decide aspects such as land ceiling limits, utilization of agricultural land, and ban on non-resident ownership, which implies that NRIs must take advice from local legal experts while planning to invest in property in different states

By knowing such controlling laws, NRIs are better able to deal with the intricacies of the Indian real estate sector and secure compliance with all such legal provisions.

Must Read: Property Transfer to NRI Children

Eligibility Criteria for NRIs

Types of Property NRIs Can Buy

NRIs can buy the following types of property:

- Residential properties

- Commercial properties

- Agricultural land (under restrictions)

- Plantation property (under restrictions)

Restrictions on Land Buying

Although NRIs have considerable property rights in India, there are restrictions on some forms of land, which are as follows:

- Agricultural Land: Generally, NRIs are not allowed to buy agricultural land, plantation properties, or farmhouses without special permission from RBI. However, NRIs can acquire such properties through inheritance.

- Property in Restricted/Protected Areas: Certain land area comes under regions which are close to international boundaries or identified by the government as protected/restricted areas. In order to buy such properties, prior permission from the RBI is required. These rules may relate to security, usage, or something else. It is important to verify such rules and regulations of the local area before investing in such land/properties.

- State-specific Restrictions: Certain states have additional restrictions on property ownership by non-residents. Jammu and Kashmir, Himachal Pradesh, and some northeastern states, for instance, have specific rules capping land ownership.

Financial Regulations

Certain financial regulations have to be followed by NRIs:

- Payment Methods: Payments have to be made through regular banking channels utilizing inward remittances from overseas or from NRE/FCNR/NRO accounts.

- Repatriation Restrictions: Although income from property may be repatriated, restrictions apply to the repatriation of sale proceeds of immovable property.

Required Documents

Now there are some documents which are required for a smooth land registry process of the property for NRIs in India. These documents include:

Identity and Status Proof

- Passport Copy: Valid passport with visa stamps

- PIO/OCI Card: (If applicable)

- NRI Status Proof: NRI status establishing documents (employment contract, visa, etc.)

- Permanent Account Number (PAN): Necessary for property dealings

- Overseas Address Proof: Utility bills, bank statements, or government-issued documents

- Indian Address Proof: If available (not mandatory)

- Photographs: Recent passport-sized photographs

Must Read: Leave and License Agreements

Property-related Documents

- Title Documents: Sale deed, gift deed, documents of inheritance

- Property Tax Receipts: Recent receipts of payment of tax

- Encumbrance Certificate: Document showing that the property has no legal encumbrances

- Land Use Certificate: Certificate indicating allowed land use

- Property Valuation Report: By a government-approved valuer

- No Objection Certificate (NOC): From the concerned authorities, if any

Financial Documents

- Bank Statements: From NRE/NRO/FCNR account statements

- Income Tax Returns: For recent years, if submitted in India

- Foreign Inward Remittance Certificate (FIRC): Where money is transferred from overseas

- Form IPI-7/IPI-8: Purchase/sale of immovable property declaration

Legal Documents

- Power of Attorney (POA): If dealing through a local representative

- Affidavits: Where required under specific transactions

- Receipt of Stamp Duty Payment: Proof of stamp duty payment

- Legal Opinion: Legal practitioner certificate confirming ownership of property

Must Read: Reactivation of Dormant Accounts Now

The Registration Process

The land registry process for NRIs generally includes three basic steps. These steps are explained as under:

Pre-registration Steps

- Property Selection and Verification

- Perform a detailed due diligence process to ensure decision-making in an informed manner and minimize the risks effectively.

- Confirm property title and ownership history

- Check lien or encumbrances and also whether there is any pending litigation

- Confirm property dimensions and boundaries

- Legal and Technical Verification

- Hire a property lawyer for reliable title verification

- Engage an architect or engineer for the technical evaluation of the property

- Ensures conformity with local building codes and regulations

- Check for pending utility bills or outstanding property tax payments

- Financial Arrangements

- Make sure the payment made through proper banking channels

- Ensure compliance with FEMA regulations

- Receipt for the proof of payments of stamp duty and registration fees or any other fees.

- Calculate potential tax implications

Executing the Agreement

- Preliminary Agreement

- It is always advisable to sign a preliminary agreement or Memorandum of Understanding (MOU) for better understanding of the agreement for all the parties.

- Proof of receipt for payment of token money (if applicable)

- Confirm the final terms and conditions for the sale and purchase of the property

- Sale Deed Preparation

- A legal professional should be engaged to draft the sale deed

- Include all necessary terms and conditions which are acceptable to the parties involved

- To avoid any confusion and dispute, specify the payment schedule and possession date in the sale deed

- Address specific NRI-related clauses

- Power of Attorney (If required)

- Execute a POA to represent your interest in case personal presence is not possible

- Register the POA with the appropriate authorities

- Clearly define the rights, obligations and limitations of POA representative

Must Read: Litigation Process in Property Disputes for NRIs

Registration Formalities

- Stamp Duty Payment

- Calculate stamp duty based on state regulations and property value

- Pay stamp duty at designated banks or through e-stamping

- Obtain receipt of payments as proof

- Document Registration

- Visit the Sub-Registrar’s office having jurisdiction over the property

- Submit the sale deed and supporting documents

- Pay registration fees

- Provide biometric verification (fingerprints)

- Obtain witnesses for signature verification

- Post-Registration Steps

- Collect registered documents

- Apply for mutation of property records

- Update municipal records

- Arrange for property insurance

- Set up mechanisms for property management

State-specific Considerations

Property laws differ significantly across Indian states, and NRIs must be aware of these variations:

| Punjab |

|

| Gujarat |

|

| Delhi NCR |

|

| Uttar Pradesh |

|

| Haryana |

|

| Maharashtra |

|

| Karnataka |

|

| Tamil Nadu |

|

| Kerala |

|

Tax Implications for NRIs

Purchase-related Taxes

- Stamp Duty: Stamp duty might range from 3% to 10% as per state laws.

- Registration Fee: Subject to state-specific caps, but it’s usually 1% of the total property value

- GST: Applicable on under-construction properties (currently 5% without ITC)

Ownership-related Taxes

- Property Tax: Annual tax levied by local municipal authorities

- Income Tax on Rental Income: Taxed at slab rates applicable to NRIs

Sale-related Taxes

- Capital Gains Tax:

- Short-term tax- (is held for less than 24 months): Tax is at normal income tax rates

- Long-term (held for more than 24 months): 20% with indexation benefits

- TDS on Sale:

- 20% TDS on capital gains for NRI sellers

- Responsibility of the buyer to deduct and deposit TDS

- Tax Deduction Opportunities:

- Reinvestment in residential property

- Investment in specified bonds

- Capital gains account scheme

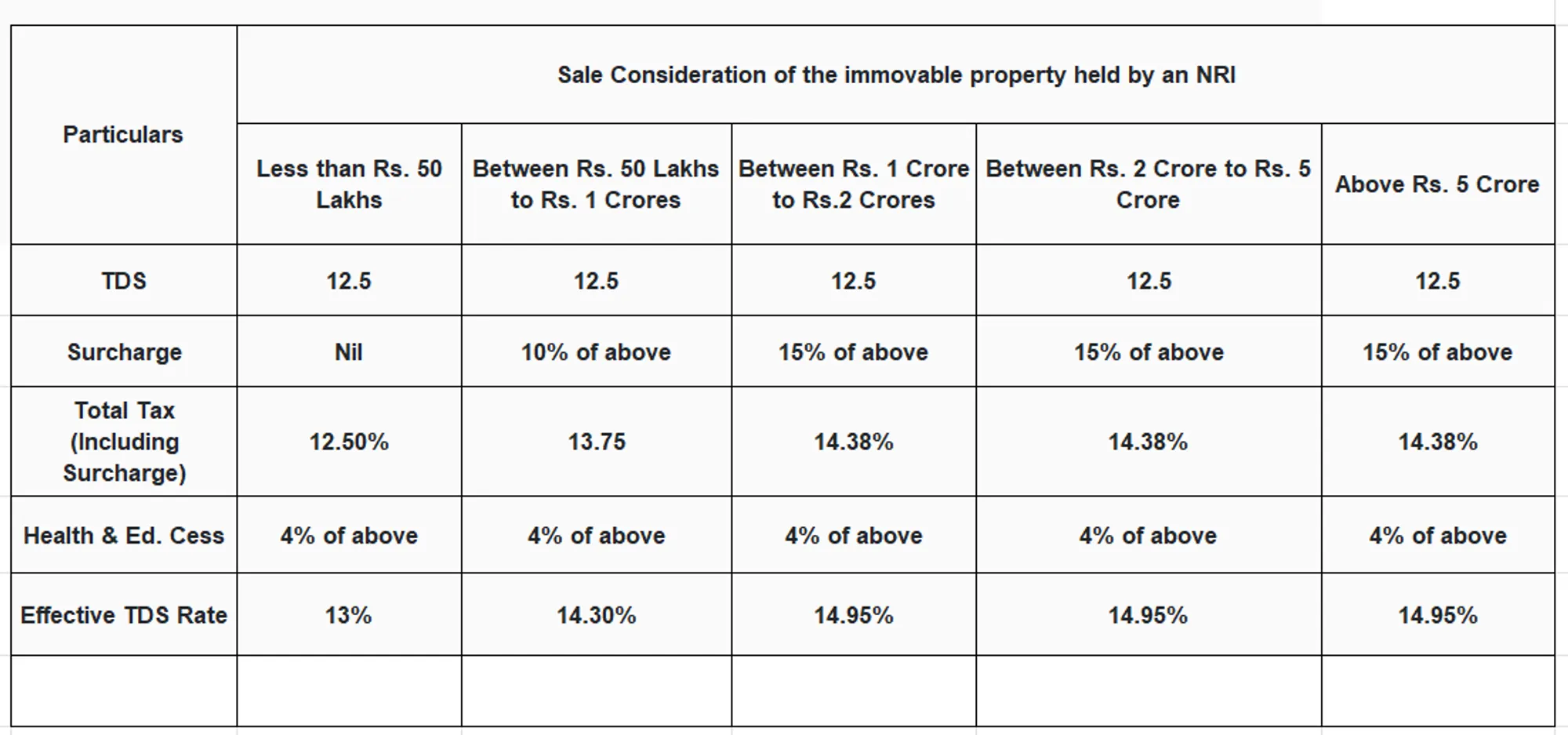

Revised TDS rate for better understanding

Common Challenges and Solutions

Challenges Faced in the land registry process by NRIs and their Solutions

- Physical Absence: Difficulty in personally managing the registration process

- Documentation Complexities: Additional paperwork due to NRI status

- Regional Variations: Understanding the different state regulations and procedures

- Property Management: Long-distance property maintenance issues

- Taxation Complexities: Dual tax implications in India and country of residence

Must Read: Selling Property in India

Effective Solutions

- Digital Solutions

- E-registration facilities where available

- Video-conferencing for mandatory appearances

- Digital document verification systems

- Professional Assistance

- Engaging reputable property lawyers

- Hiring property management services

- Consulting tax professionals familiar with NRI taxation

- Legal Safeguards

- Detailed due diligence process

- Well-drafted power of attorney

- Regular property audits

Recent Developments and Future Outlook

Digital Initiatives

Indian government’s several digital initiatives for property registration are:

- E-Registration: Online property registration systems in many states

- RERA Online Portal: For transparency in real estate transactions and deals. (Visit)

- Digital Locker: Secured storage provided for property and important documents

- Blockchain Land Records: Pilot projects for immutable land records initiated in some states.

Policy Changes

New policy changes impacting NRI property ownership:

- Simplified Repatriation: Streamlining repatriation procedures for certain types of property.

- Tax Reforms: TDS rates and capital gains computations have got changes implemented for clarity and advantage.

- RERA Implementation: Strengthening of consumer protection and increase in transparency

- GST Rationalization: Providing ease and clarity of procedures and law pertaining to GST applicability for property transactions

Conclusion

Land registry process for NRIs is a complex process of legal, financial, and procedural hurdles. Proper planning, documentation, and professional guidance can ease the complexity of this process.

With India further automating its land records and registration procedures, NRIs can look forward to an easier experience of property registration ahead.

For NRIs who want to invest in real estate sector of India, it is important to know the legal system, make detailed documentation, and take professional advice as key steps towards successful property purchase and registration.

FAQs

NRIs face specific tax considerations including 20% TDS on capital gains (which the buyer must deduct and deposit), short-term capital gains tax at normal income tax rates (for properties held less than 24 months), and long-term capital gains tax at 20% with indexation benefits (for properties held over 24 months).

Major challenges include physical absence during the registration process, additional documentation complexities due to NRI status, understanding diverse state regulations, long-distance property management issues, and navigating dual tax implications.

The main laws include the Foreign Exchange Management Act (FEMA) 1999, the Registration Act 1908, the Transfer of Property Act 1882, the Income Tax Act 1961, and various state-specific Land Reform Acts.

Recent digital initiatives include e-registration systems in many states, the RERA online portal for transparency, Digital Locker for secure document storage, and pilot blockchain land record projects in some states.

Required documents include a valid passport with visa stamps, PIO/OCI card (if applicable), NRI status proof, Permanent Account Number (PAN), overseas address proof, and recent photographs.

Payments must be made through regular banking channels using inward remittances from overseas or from NRE/FCNR/NRO accounts.

NRIs need title documents (sale deed, gift deed, inheritance documents), property tax receipts, an encumbrance certificate, land use certificate, property valuation report, and any required No Objection Certificates.

Residential and commercial properties can be purchased legally by NRIs. However, agricultural land, plantation properties, and farmhouses require RBIs special permission, though NRIs can acquire these through inheritance.

NRI is an Indian citizen residing outside India for employment, business, or other purposes with the intention to stay permanently. This includes Indian citizens working abroad, studying overseas, or Indian passport holders who have been outside India for 182 days and more, in the preceding financial year. Persons of Indian Origin (PIOs) and Overseas Citizens of India (OCIs) are also covered, though their property rights may vary.